Risk & Compliance Innovation

Transform your risk management strategy with advanced frameworks and methodologies designed specifically for Chief Risk Officers (CRO) navigating today's complex regulatory landscape.

57%

Reduction in risk incidents

82%

Compliance automation

41%

Faster regulatory response

3.4x

Risk-adjusted ROI improvement

Risk & Compliance Management Frameworks

Strategic Methodologies for Modern Chief Risk Officers

Our comprehensive risk and compliance frameworks are designed to help CROs transform their risk management strategy and create resilient, compliant organizations in today's complex regulatory environment. These strategic maps provide a holistic view of how risk excellence connects to tangible business outcomes across your entire organization.

Key Challenges Facing Today's CRO

Modern Chief Risk Officers must navigate increasing regulatory complexity, emerging risks, and digital transformation challenges. Our frameworks address these critical issues while enabling innovation and sustainable business growth.

Regulatory Complexity

Managing the proliferation of global regulations and compliance requirements across jurisdictions

Digital Risk Management

Adapting risk frameworks to address cybersecurity, data privacy, and technology disruption

Compliance Automation

Implementing technology solutions to streamline compliance processes and reduce manual effort

Risk Culture Development

Fostering risk awareness and ownership across all organizational levels and functions

Benefits of Our CRO Solutions

Proactive Risk Management

Transform reactive risk mitigation into proactive risk intelligence that anticipates issues before they impact operations.

Optimized Risk-Adjusted Returns

Enhance decision-making with sophisticated risk models that balance opportunity pursuit with appropriate risk controls.

Compliance Excellence

Achieve regulatory compliance with 70-85% less effort through advanced automation, smart workflows, and predictive analytics.

Organizational Resilience

Build adaptive capacity to withstand disruptions and recover quickly from unexpected events through integrated risk management.

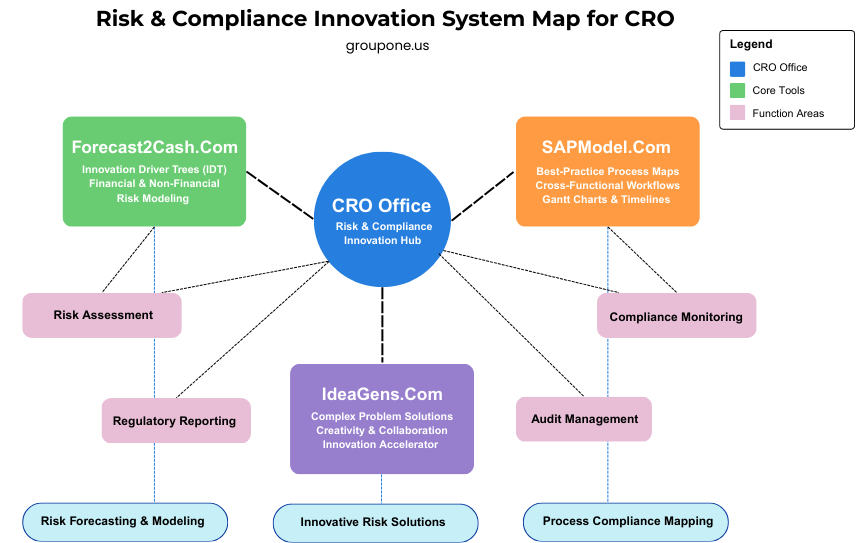

Risk & Compliance Innovation System Map

This comprehensive system map illustrates how the CRO Office serves as a central hub for risk and compliance innovation, connecting core tools and functional areas. It provides a clear visualization of workflows and dependencies between different components of your risk management ecosystem.

System Map Components

Integrated FrameworkOur Risk & Compliance Innovation System Map connects three key elements to create a comprehensive risk management ecosystem:

| Component | Key Functions | Business Impact | Implementation Tools |

|---|---|---|---|

CO CRO Office | Risk & Compliance Innovation Hub, Strategic Oversight, Stakeholder Communication | Centralized risk governance | All Platforms |

CT Core Tools | Financial & Non-Financial Risk Modeling, Process Maps & Workflows, Complex Problem Solving | Enhanced risk intelligence | Forecast2Cash.ComSAPModel.ComIdeaGens.Com |

FA Function Areas | Risk Assessment, Regulatory Reporting, Compliance Monitoring, Audit Management | Streamlined risk operations | Various Departments |

Global Financial Institution

A leading financial services organization implemented our Risk Management Framework, achieving:

- 68% reduction in compliance violations

- 45% faster regulatory reporting processes

- $12.8M annual savings in risk-related costs

- 89% increase in early risk detection

"The Risk & Compliance Innovation Strategy Map revolutionized our approach to enterprise risk management. It enabled us to move from a siloed, reactive stance to an integrated, proactive risk intelligence framework. Not only have we significantly reduced our risk exposure and compliance costs, but we've transformed risk management into a strategic advantage for our business."

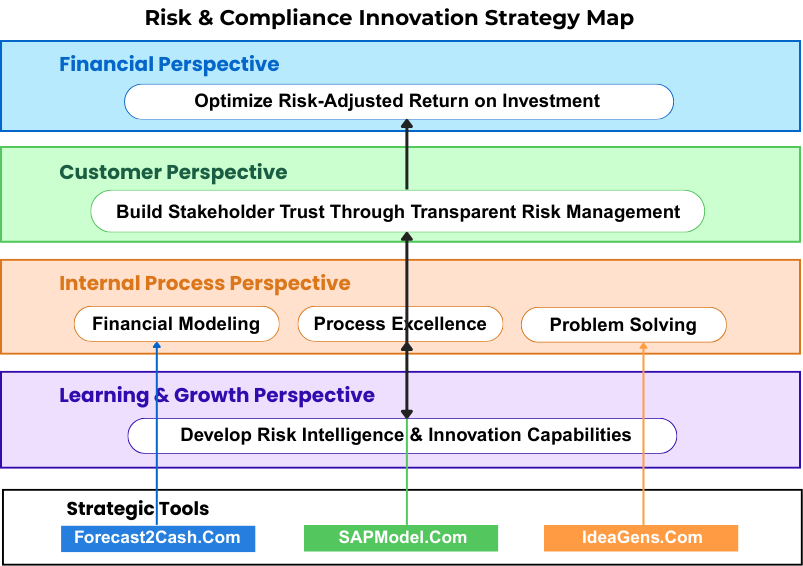

Risk & Compliance Innovation Strategy Map

Our comprehensive strategy map aligns risk management across four key perspectives: financial, customer, internal process, and learning & growth. This balanced scorecard approach ensures that your risk strategy delivers measurable business value while building capabilities for future challenges.

Key Components:

Implementation Methodology

Proven SuccessOur proven five-phase implementation methodology ensures successful adoption of risk and compliance frameworks within your organization, with clear milestones and deliverables:

Risk & Compliance Assessment

Comprehensive evaluation of current risk management practices, compliance processes, and control effectiveness across the organization.

Strategy Map Development

Customization of risk and compliance frameworks to align with your organization's risk profile, industry requirements, and strategic objectives.

Technology Integration

Implementation of risk intelligence tools, compliance automation, and integrated reporting systems to support the new risk framework.

Enterprise-Wide Rollout

Systematic implementation across business units with comprehensive training, change management, and executive sponsorship to drive adoption.

Continuous Risk Intelligence

Establishment of ongoing monitoring, scenario analysis, and adaptive response mechanisms to maintain effectiveness in changing risk environments.

Ready to Transform Your Risk Management Strategy?

Our frameworks integrate with our existing solutions to create a comprehensive risk intelligence ecosystem tailored to your specific industry challenges.

CRO Excellence Program

Join our specialized program for Chief Risk Officers to access exclusive resources, expert insights, and peer networking opportunities.